Dallas/Fort Worth Real Estate: The 2024 Outlook

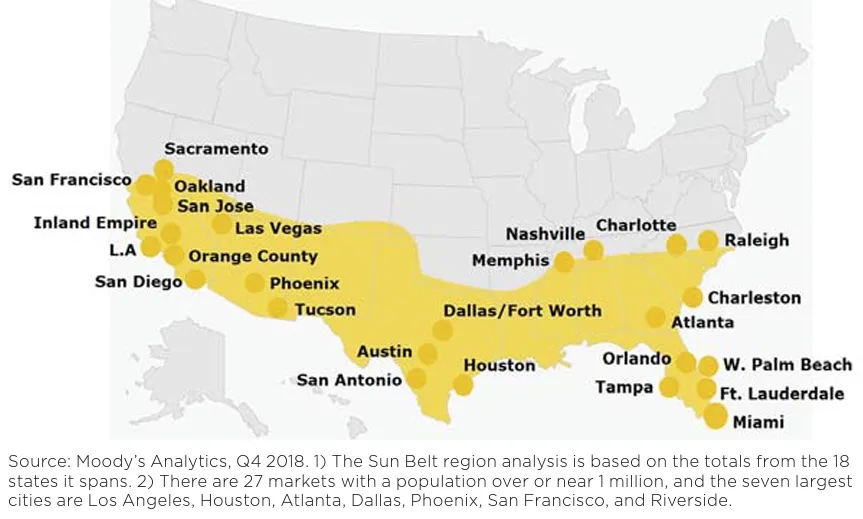

As we look towards 2024, the Dallas/Fort Worth area stands at the forefront of a significant real estate shift, prominently featured in the Sun Belt States. The Sun Belt runs from Southern California, across the Southern tier of the US to Southern North Carolina. The region includes 18 states: Alabama, Arkansas, Arizona, California, Colorado, Florida, Georgia, Kansas, Louisiana, Mississippi, North Carolina, New Mexico, Nevada, Oklahoma, South Carolina, Tennessee, Texas, & Utah, and is expected to experience the strongest residential real estate growth in the United States during 2024. Featured in a recent Dallas Agent Magazine article, this insight comes from the authoritative "2024 Emerging Trends in Real Estate" report, an annual collaborative effort by PwC and the Urban Land Institute, which provides a deep dive into the evolving landscape of the real estate market across the U.S. and Canada.

The Sun Belt Surge

The Sun Belt, with Dallas/Fort Worth as a key player, is forecasted to experience the strongest growth in residential real estate. This growth is driven by factors such as favorable weather, affordable housing, and strong job markets. The report, based on insights from over 2,000 real estate experts, notes that 15 of the top 20 markets for overall prospects are in the Sun Belt. The article in Dallas Agent Magazine specifically named the top 10 markets to watch in 2024:

1. Nashville

2. Phoenix

3. Dallas/Fort Worth

4. Atlanta

5. Austin

6. San Diego

7. Boston

8. San Antonio

9. Raleigh/Durham

10. Seattle

A New Real Estate Era

Anita Kramer from ULI highlights the industry's transformation, driven by hybrid work models and a robust retail sector. Retail demand, in particular, has seen a dramatic increase, with the U.S. adding approximately 35 million square feet of new retail space in 2023 alone. Despite slight caution in development and investment ratings, the industry is poised for innovation and adaptation in response to these shifts.

The Great Reset

Dubbed "The Great Reset," this era in real estate represents a shift from past benchmarks. Hybrid work is a key factor, as evidenced by a decline in the appeal of office buildings and an increase in vacancies, leading to discussions on repurposing or demolishing office buildings for more economical uses.

Remote Work and Migration Trends

The pandemic has accelerated migration to the Sun Belt, with younger, more affluent workers seeking relocation. This demographic shift indicates a growing need for housing in suburbs and smaller cities, reshaping the demand in the residential real estate market.

Shifting Commercial Landscape

The commercial sector faces significant changes, with office buildings losing their appeal to investors. This shift is part of a broader adaptation to hybrid work models and changing workplace preferences, emphasizing the need for real estate firms to adapt and innovate in this new environment.

Adapting to New Technologies and Climate Challenges

The real estate industry is also learning to navigate new technologies, such as AI, to enhance property searches and investment assessments. Moreover, the industry faces the challenge of adapting to climate change, with an increasing number of billion-dollar climate events influencing development strategies and emphasizing the need for sustainable practices.

Reinventing Downtowns and Addressing Housing Crunch

Downtown areas are under pressure to reinvent themselves to maintain economic vitality, as they face competition from alternative live/work/play communities. Additionally, the U.S. is grappling with a housing affordability crisis, prompting the need for more housing construction across various price points to alleviate this issue.

The Dallas/Fort Worth real estate market in 2024 is set to reflect these broader trends: a shift towards suburban living, influenced by the rise of remote work, technological advancements, and changing demographics. As the industry adapts to "The Great Reset," the landscape of real estate investment and development in this region is poised for significant transformation, highlighting the need for innovative and sustainable solutions in the face of evolving challenges and opportunities.

Source:

Dallas/Fort Worth identified as a top market for growth in 2024 - Dallas Agent Magazine

The Sun Belt is poised for real estate growth, according to the Emerging Trends in Real Es...

Selling Your Home?

Get your home's value - our custom reports include accurate and up to date information.

.png)

.png)

.png)